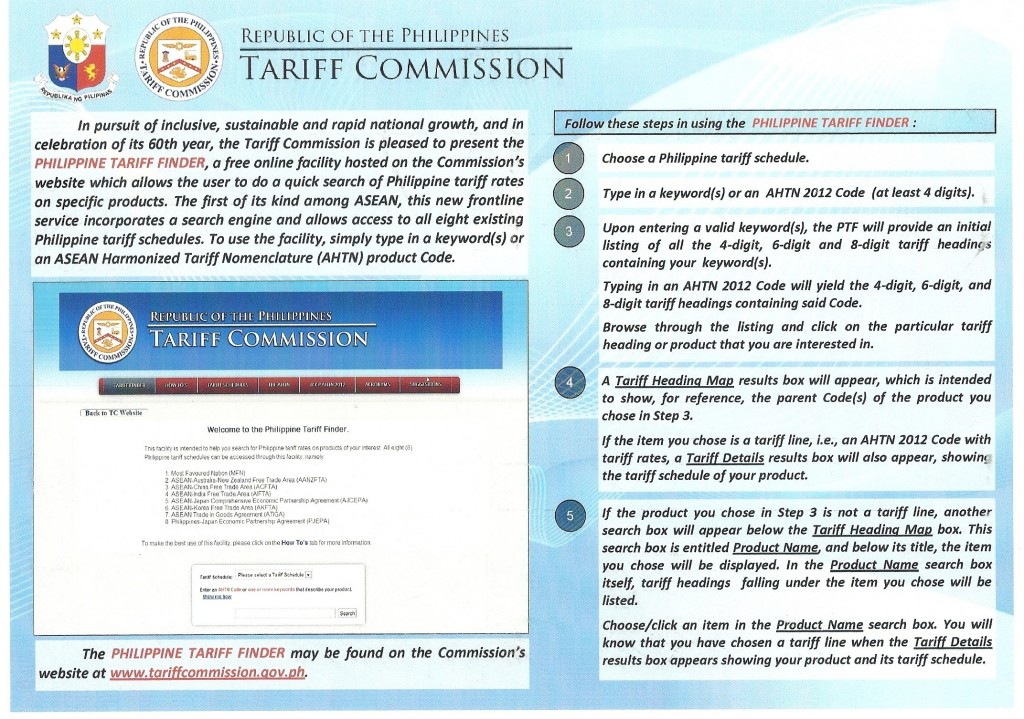

Tariff Commission

- WHAT ARTICLES ARE SUBJECT TO DUTY AND TAX?

- WHEN DOES IMPORTATION BEGIN AND WHEN IS IT DEEMED TERMINATED?

- WHO ARE AUTHORIZED TO LODGE A GOODS DECLARATION?

- WHEN TO LODGE A GOODS DECLARATION?

- WHAT ARE THE TYPES OF GOODS DECLARATION?

1. WHAT ARTICLES ARE SUBJECT TO DUTY AND TAX?

All goods imported into the Philippines are subject to duty and tax upon importation, including goods previously exported from the Philippines, except as otherwise provided for in the CMTA or in other laws.

2. WHEN DOES IMPORTATION BEGIN AND WHEN IS IT DEEMED TERMINATED?

Importation begins when the carrying vessel/aircraft enters the Philippine territory with the intention to unload therein. Importation is deemed terminated when:

(a) The duties, taxes and other charges due upon the goods have been paid or secured to be paid at the port of entry and the legal permit for withdrawal has been granted; or

(b) In case the goods are deemed free of duties, taxes and other charges, the goods have legally left the jurisdiction of the Bureau.

3. WHO ARE AUTHORIZED TO LODGE A GOODS DECLARATION?

The following are authorized to lodge a goods declaration:

- The importer, being the holder of the bill of lading;

- A customs broker acting under the authority of the importer or from a holder of the bill; or

- A person duly empowered to act as agent or attorney-in-fact for each holder.

4. WHEN TO LODGE A GOODS DECLARATION?

A goods declaration must be lodged within 15 days from the date of discharge of the last package from the vessel or aircraft. Upon request, the period to file the goods declaration may be extended on valid grounds for another 15 days: Provided that the request is made before the expiration of the original period within which to file the goods declaration.

Failure to lodge the goods declaration within the prescribed period constitutes an implied abandonment of the goods.

5. WHAT ARE THE TYPES OF GOODS DECLARATION?

There are 2 types of goods declaration (for consumption), to wit:

a. Informal Entry, which covers

-

- Goods of a commercial nature with Free on Board (FOB) or Free Carrier (FCA) value of less than PHP 50,000; and

- Personal and household effects or goods, not in commercial quantity, imported in a passenger’s baggage or mail.

b. Formal Entry, which covers goods of a commercial nature with Free on Board (FOB) or Free Carrier (FCA) value of not less than PHP 50,000.

All imported goods shall be subject to the lodgment of a goods declaration.

(Source: CMTA)

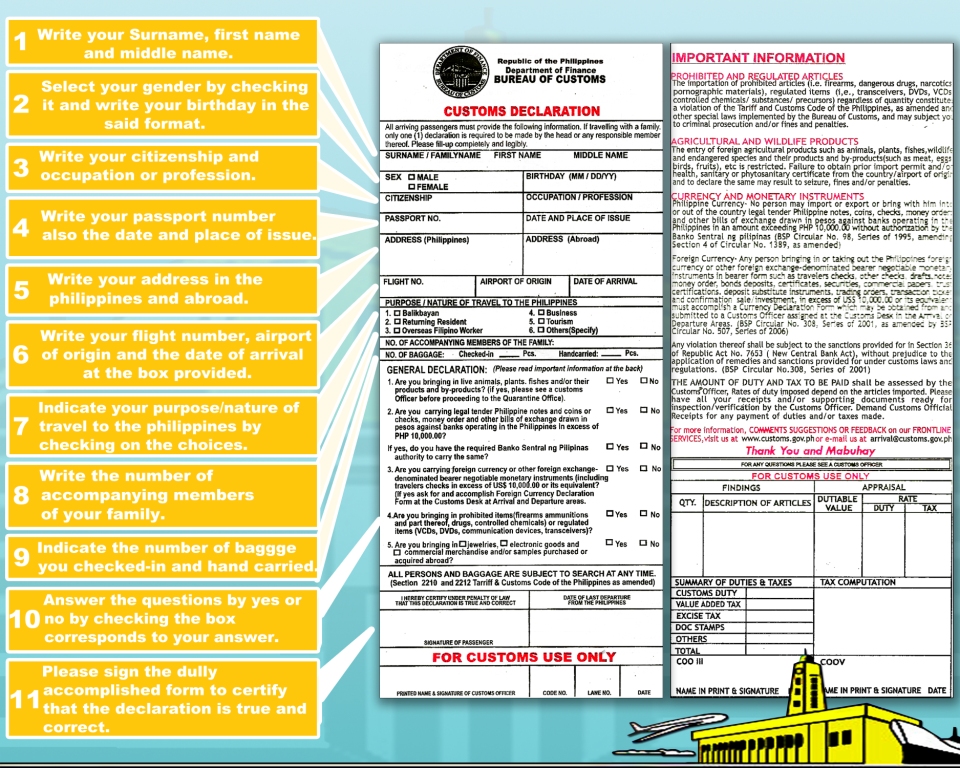

Philippines Customs Declaration Form

Contact Details

632-8705-6000

OFFICE OF THE COMMISSIONER

G/F OCOM Building, 16th Street

South Harbor, Port Area, Manila

https://customs.gov.ph